does td ameritrade report to irs

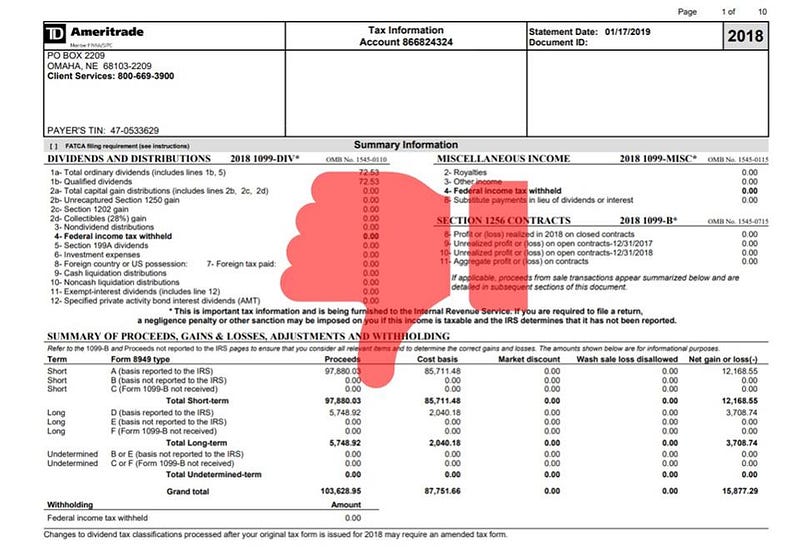

Due to Internal Revenue Service IRS regulatory changes that have been phased in since 2011 TD Ameritrade is now required as are all broker-dealers to report adjusted cost basis gross proceeds and the holding period when certain securities are sold. The reason is simple.

1099 Information Guide Pdf Free Download

The form covers the following areas.

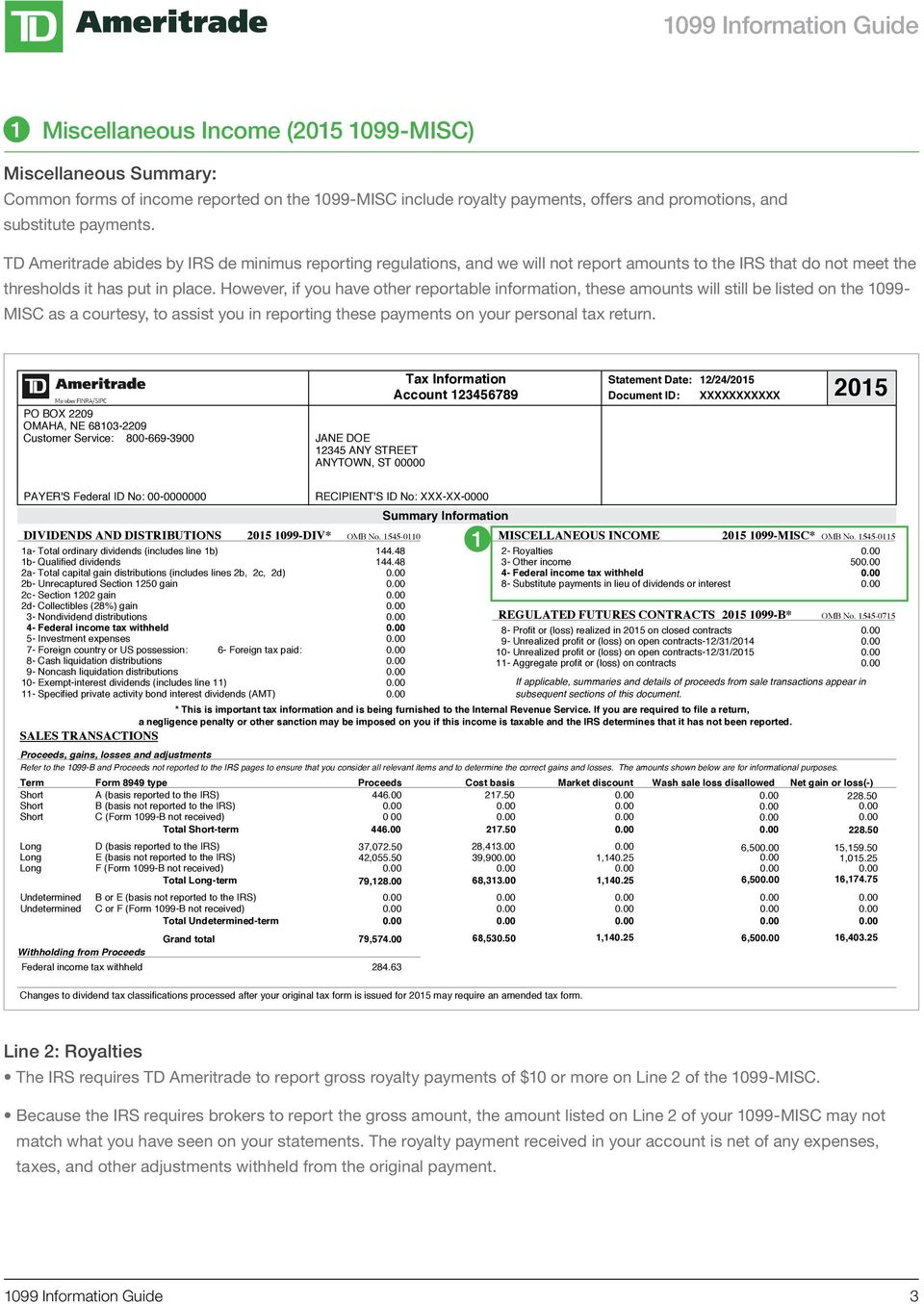

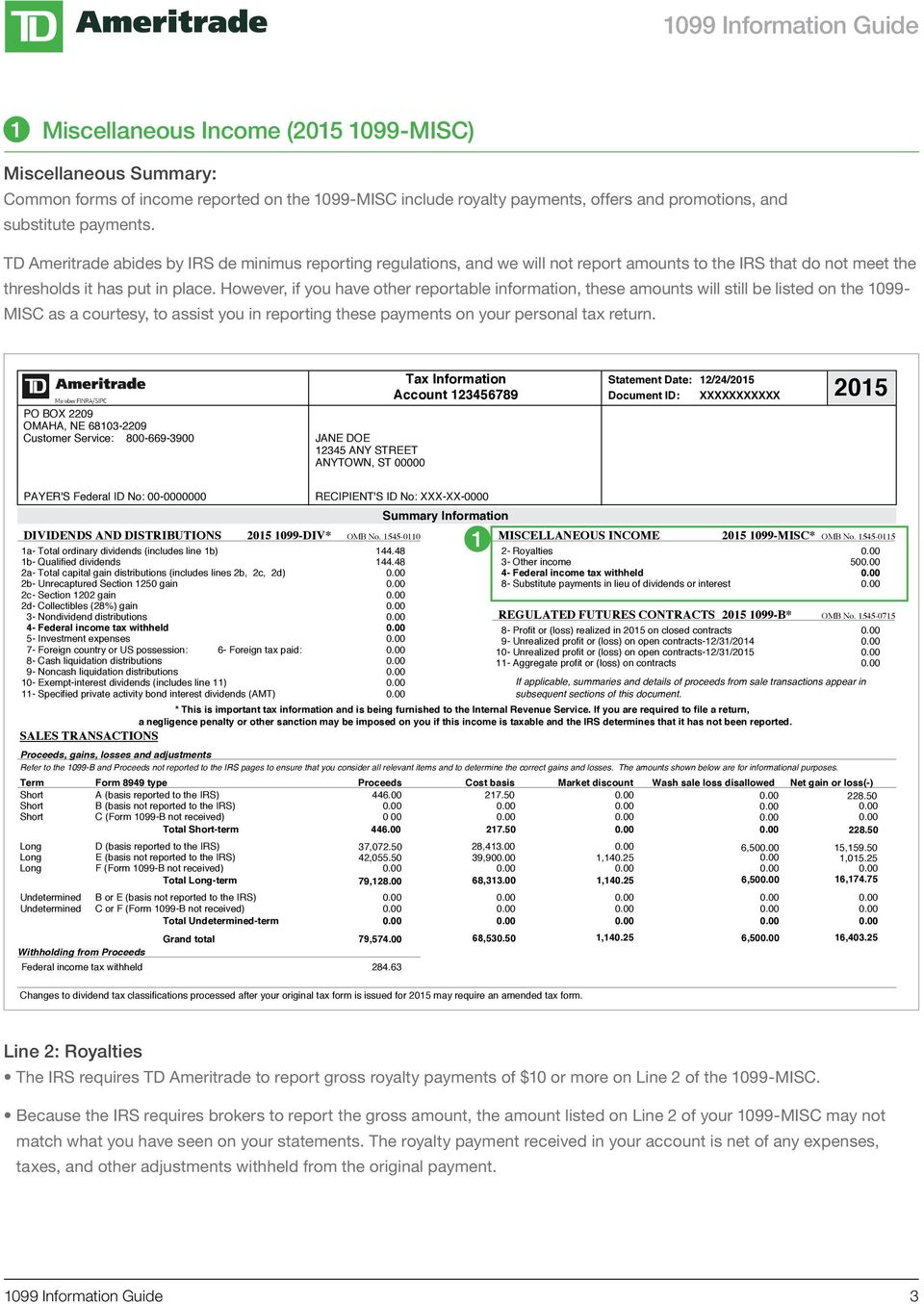

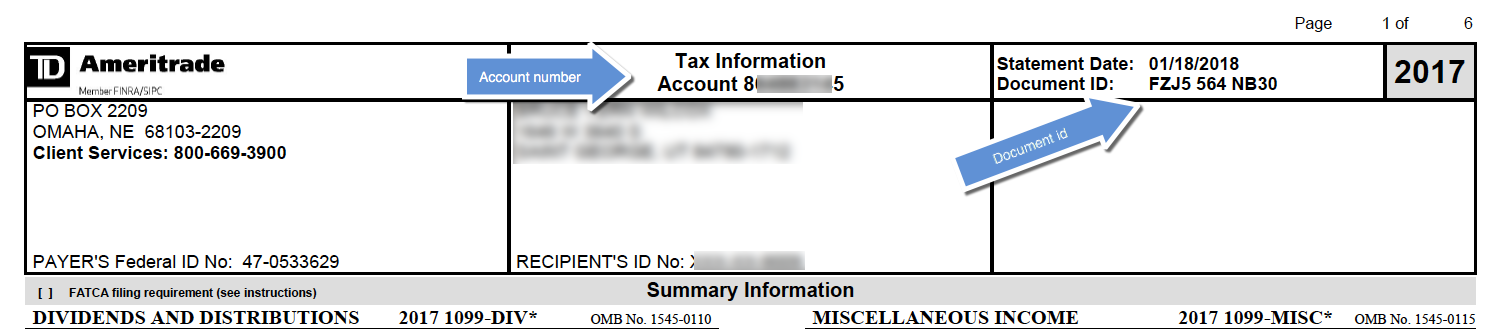

. TD Ameritrade abides by IRS de minimus reporting regulations and we will not report amounts to the IRS that do not meet the thresholds it has put in place. The IRS has updated the 2021 Form 1099-DIV to include two new boxes. I believe they report columns 1a through 1f on forms 8949 the gain or loss is calculated on column 1g.

Box 2e - Section 897 ordinary dividends. If you have any questions regarding your Consolidated Form 1099 please contact a Client Services representative. What does TD AMERITRADE report to the IRS.

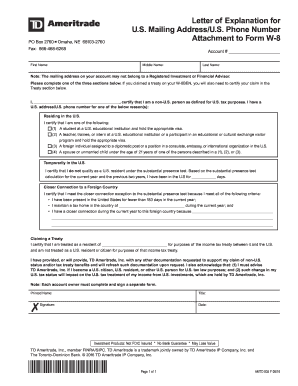

Or qualified foreign corporation and it is readily tradable on a US. Your Drivers License or Passport Details. TD Ameritrade does not report this income to the IRS.

Do I need to report anything on my tax return if I havent withdrawn any funds from the account. What you need to report to the IRS. The IRS treats virtual currencies as property which means theyre taxed similarly to stocks.

But they do report the basis and sale price. If you have any questions regarding your Consolidated Form 1099 please contact a Client Services representative. They dont report the gain or loss to the IRS.

The cost basis information TD Ameritrade provides for tax-exempt accounts is for client use only. Box 2e and Box 2f. Prior to 2011 firms such as TD Ameritrade reported only sale proceeds.

You must enter the gain or loss on sales of securities dividends and interest earned etc. TDA will provide you with a form known as a Consolidated. Reinvesting dividends automatically into more shares of common stock is known as DRiP or Distribution Reinvestment Plan.

Best Broker for Beginners and Best Broker for Mobile. The IRS paid the correct amount 9948 of the time but nearly 645000 potential recipients are still waiting a Treasury Department watchdog report says When it came to quickly distributing stimulus checks on a massive scale the Internal Revenue Service worked out the glitches by the third round according to a recent Treasury Department. Questions relating to specific tax issues however should be directed to your tax advisor.

1099-DIV Distributions such as ordinary dividends qualified dividends capital gains and non-taxable distributions that were paid in stock or cash. This data can sometimes be cumbersome when served in large quantities but you can export it into Excel or to a printer-friendly page. Upon settlement youll find the lots you selected applied to the Realized GainLoss tab and TD Ameritrade will send your selection on to the IRS once tax reporting time rolls around.

TD Ameritrades DRiP doesnt incur reinvestment fees or commissions and. Ask Your Own Tax Question. Intraday data is delayed at least 20 minutes.

Best Broker for Options and Best Broker for Low Costs. TD Ameritrade will not report cost basis information on tax-exempt accounts to the IRS. It is up to the prudent investortrader to remove these wash sales so the loss can be used to offset the gain from another trades.

TD Ameritrade will need to report to the IRS how much you earn from trading securities. TD Ameritrade does not report this income to the IRS. This section is very useful for information about reportable transactions tax documents availability tax reporting questions and RMD calculations just to name a few.

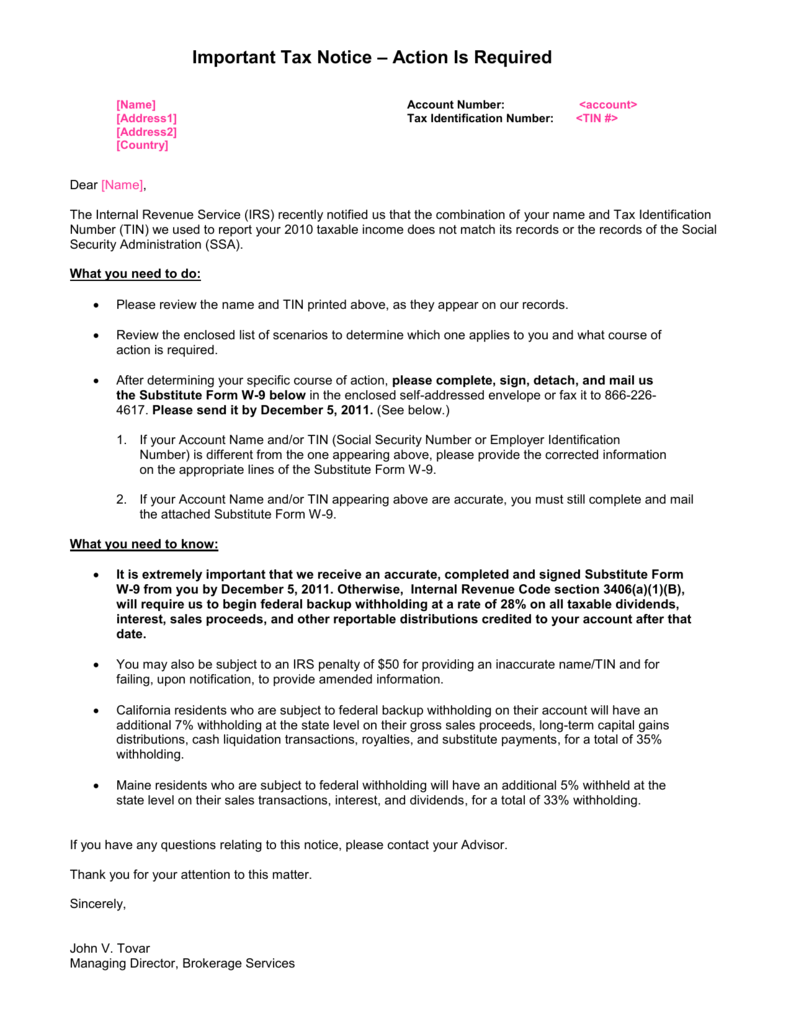

TD AMERITRADE uses the following forms to report income and securities transactions to the IRS. Questions relating to specific tax issues however should be directed to your tax advisor. However if you have other reportable information these amounts will still be listed on the 1099-MISC as a courtesy to assist you in reporting these payments on your personal tax return.

However TD Ameritrade does not report this income to the IRS. Opinion or advice regarding securities or markets contained in such material does not reflect the views of TD Ameritrade and TD Ameritrade does not verify any information included in such material. This includes non-taxable payments.

GainsKeeper service and performance reporting is offered and conducted by Wolters Kluwer Financial Services Inc. If you use a Tax Pro you can save your tax preparer time and save tax preparation fees. However you are still required to report the transaction when you file your tax return.

I have their email. I just confirmed with TD ameritrade that Brokers do not remove wash sales from 1099b when the security is sold disposed and never trades in the last two month of the year. Regardless of whether you withdrew money from your account or not.

Interest Income Form 1099-INT reports all interest payments such as bond interest. Your TD Ameritrade Consolidated Form 1099 Weve consolidated five separate 1099 forms into one comprehensive form containing information we report to the IRS. I recently opened an account with TD Ameritrade.

What does TD Ameritrade report to IRS. OANDA does not report taxes on behalf of our clients and as a result we do not provide any tax forms relating to profitloss on your account eg. TD Ameritrade does not report this income to the IRS.

If you use tax software we can help you either 1 import your data into HR Block. The Emergency Economic Stabilization Act of 2008 requires that brokerage firms and mutual fund companies report their customers cost basis and holding period on covered securities to the IRS on their Consolidated Form 1099s when securities are sold. Information in the Supplemental Information section of the Consolidated Form 1099 is provided for your convenience only.

Your Consolidated Form 1099 does list income less than 10. Does Oanda report to IRS. On top of that they will also need to confirm your identity to limit money laundering.

Ad Wide Range of Investment Choices Access to Smart Tools Objective Research and More. A Consolidated 1099 Form which consists of. If you sell options purchased before January 1 2013 the broker may not report the sale to the IRS.

Shows the portion of the amount in. TD Ameritrade will report a dividend as qualified if it has been paid by a US. TD Ameritrade has a dedicated tax reporting section on their platform called.

TD Ameritrade handles all taxable reporting for your clients accounts and the. TD Ameritrades DRiP or Dividend Reinvestment Plan is an easy and innovative approach to possibly grow your investment account.

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

Get Real Time Tax Document Alerts Ticker Tape

How To Read Your Brokerage 1099 Tax Form Youtube

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape

1040s 1099s Other Federal Tax Forms What You Mig Ticker Tape

Td Ameritrade W8ben Fill Online Printable Fillable Blank Pdffiller

Tax Forms Every Investor Should Know About Novel Investor

Td Ameritrade Ofx Import Instructions

New Year S Resolution Get Up To Speed On New Ira Rol Ticker Tape

Things To Remember Around Tax Time If You Ve Made A Qualified Charitable Distribution Merriman

Are You Considering These 4 Things When Choosing A Crypto Tax Software Cointracker

What Are Qualified Dividends And Ordinary Dividends Ticker Tape